Splitting the receipt tax amount

Overview

If you want to apply a tax rate to a receipt, but not all of the items are taxable, a taxable line item and a non-taxable line item need to be created.

Instead of manually calculating these amounts and creating the line items, these can be automatically generated using the split tax feature.

Splitting the tax rate

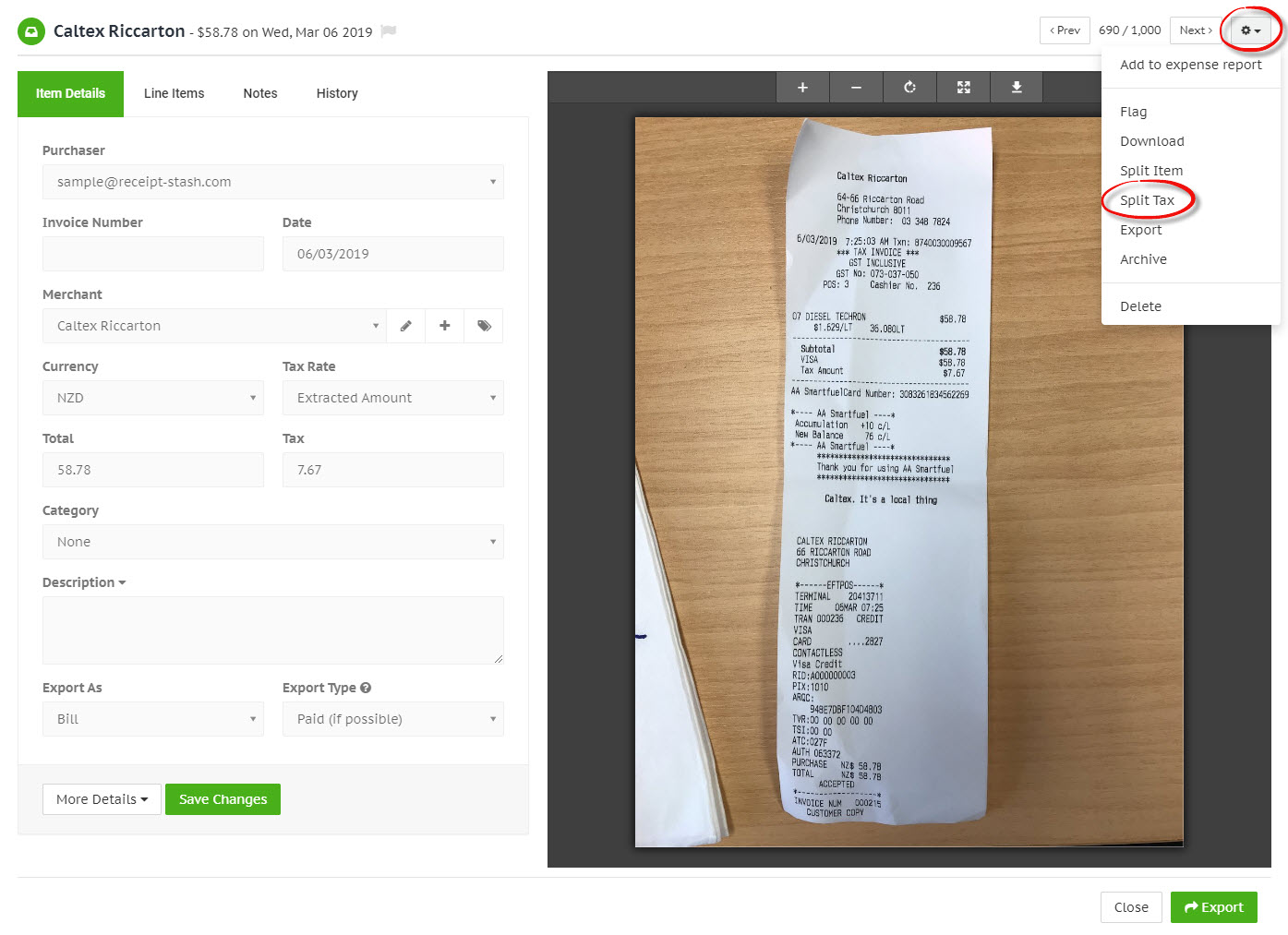

Navigate to the Receipts page and open the receipt window for your selected receipt by clicking the link in the Merchant column.

Click the cog button in the top right-hand corner of the receipt detail window, and from the dropdown list click Split tax. A window will appear with a number of options to choose from.

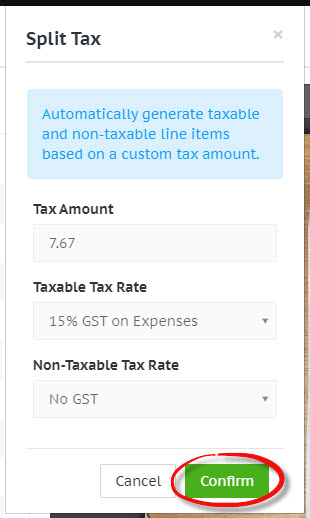

Enter the actual amount of tax you want to apply to the receipt, then select the tax rate (for the taxable amount to applied to) and a non-taxable rate (for the remainder of the receipt to be applied to). Click the green Confirm button at the bottom of the window when you're ready to generate the line items.

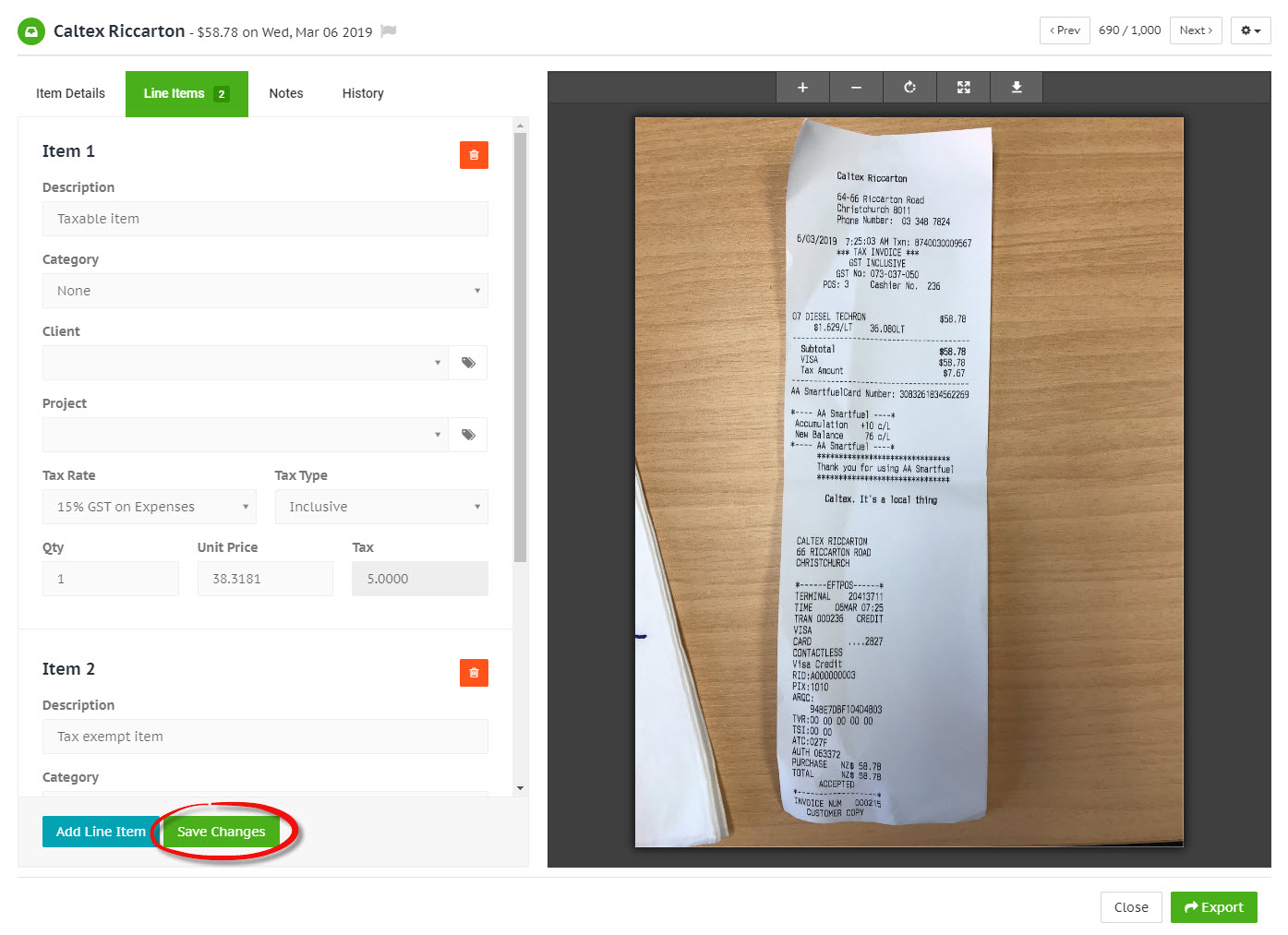

The receipt tax amount will be updated to reflect the tax amount you entered, and two line items will automatically be generated; one for the taxable amount, and another for the remainder of the receipt (the non-taxable amount). Click the green Save Changes button at the bottom of the Line Items tab window to apply the changes.

See also

See Receipt line items to learn more about creating line items for a receipt.