Merchant line split rules

Overview

Merchant line split rules automatically generate line items when new receipts are submitted for the merchant.

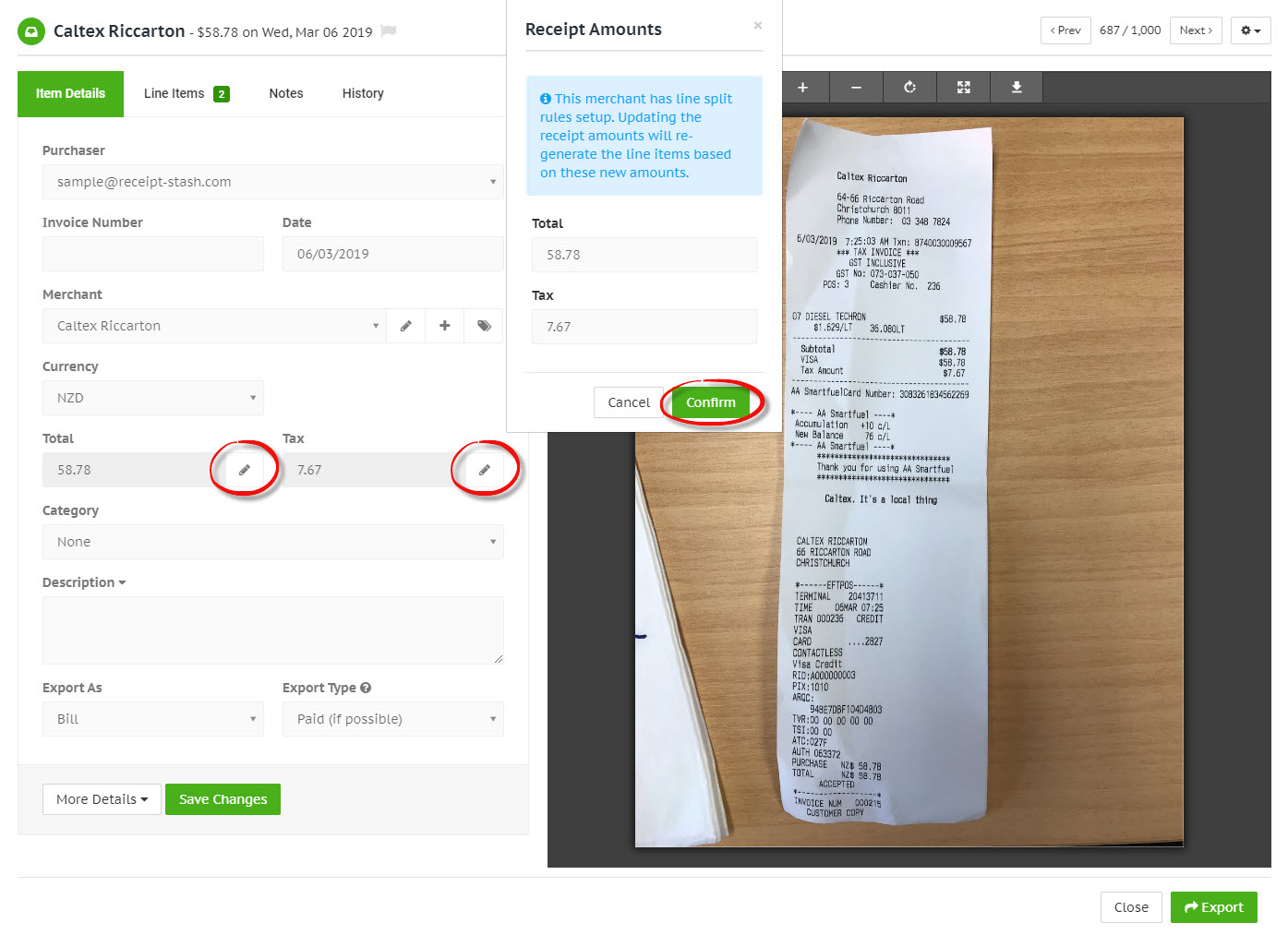

The rules are applied against the total and tax amounts extracted from the receipt and can be generated or re-generated when you update the receipt amounts, or if you change the merchant on the receipt to a merchant that has line split rules set up.

This can be useful when you have regular line items for a merchant receipt or invoice, or if they need to be categorised or coded to multiple items instead of just one.

Setting up line split rules

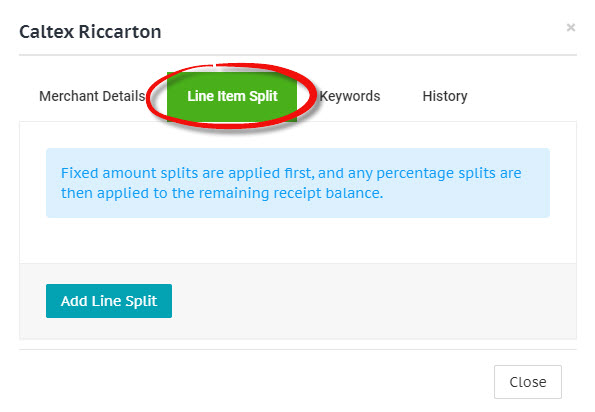

Navigate to the Merchants page and open a selected merchant by clicking the green link in the Merchant Name column.

Within the merchant window, click on the Line Item Split tab to view, edit, or delete existing rules, or to add new ones.

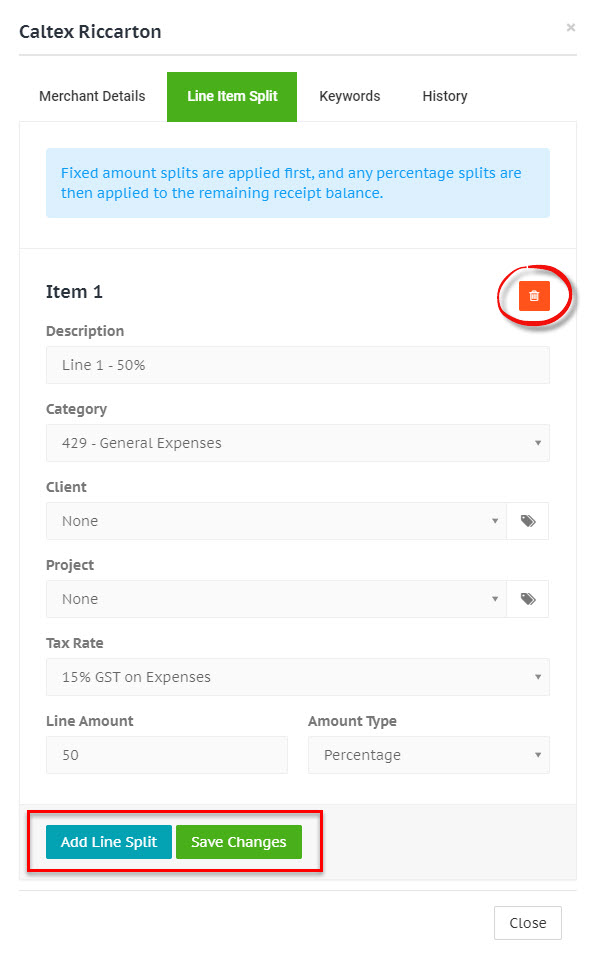

Click the Add Line Split button at the bottom of the line item split form to add and enter the details for the new line split rule. Make changes to existing rules or remove them by clicking the red trash icon in the top right-hand corner of the split rule.

Any additions or changes to the merchant line splits need to be confirmed by clicking the green Save Changes button at the bottom of the line item split form.

Rules can be made up of a combination of fixed amount and percentage splits, which are applied against the receipt total and tax amounts. Any fixed amount splits will be applied against the receipt amounts first, and any percentage splits will be applied against the remaining receipt amounts (if any).

Re-generating receipt line items

If the receipt amounts were extracted incorrectly (and therefore the line item amounts are incorrect), instead of changing each line item amount, you can update the receipt total or tax amounts and this will re-generate the line items using the corrected amounts.